Urbanism Next Research Papers Series – Re-Imagining Retail

While we have been compiling research and articles on this blog for the last few months, we have also been working on our own research. Today marks the start of our publishing a series of brief papers on issues related to Urbanism Next. The intention is to introduce you to some key topics that will be affecting how cities develop as they face ongoing and transformative changes in technology.

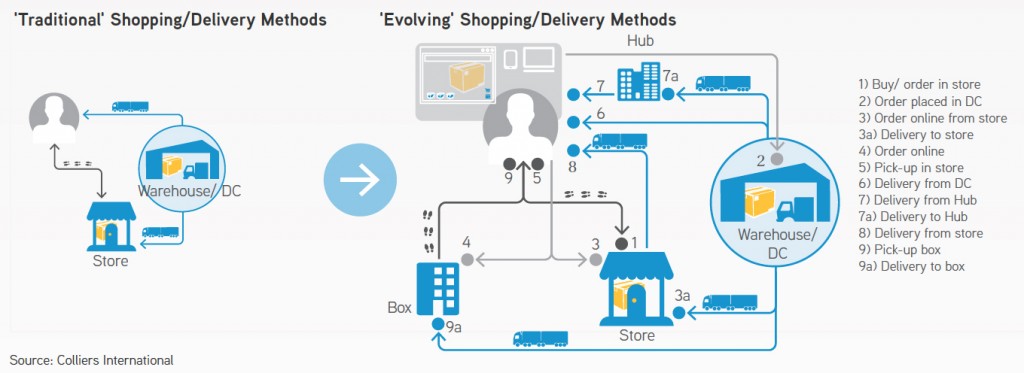

The first paper is co-written by Galen Carlson and Nico Larco and is focused on Re-Imagining Retail. Building on earlier posts about the challenges retail is currently facing, we look at the transformation retail is currently going through and the shift from brick-and-mortar, to e-commerce, to omnichannel approaches. The paper describes trends and includes data and resources that can help you understand where we are at, where we are heading, and where you can learn more.

Look for additional papers on residential preferences, warehousing, and the effects of urbanism next issues on municipal budgets – coming in the coming weeks.