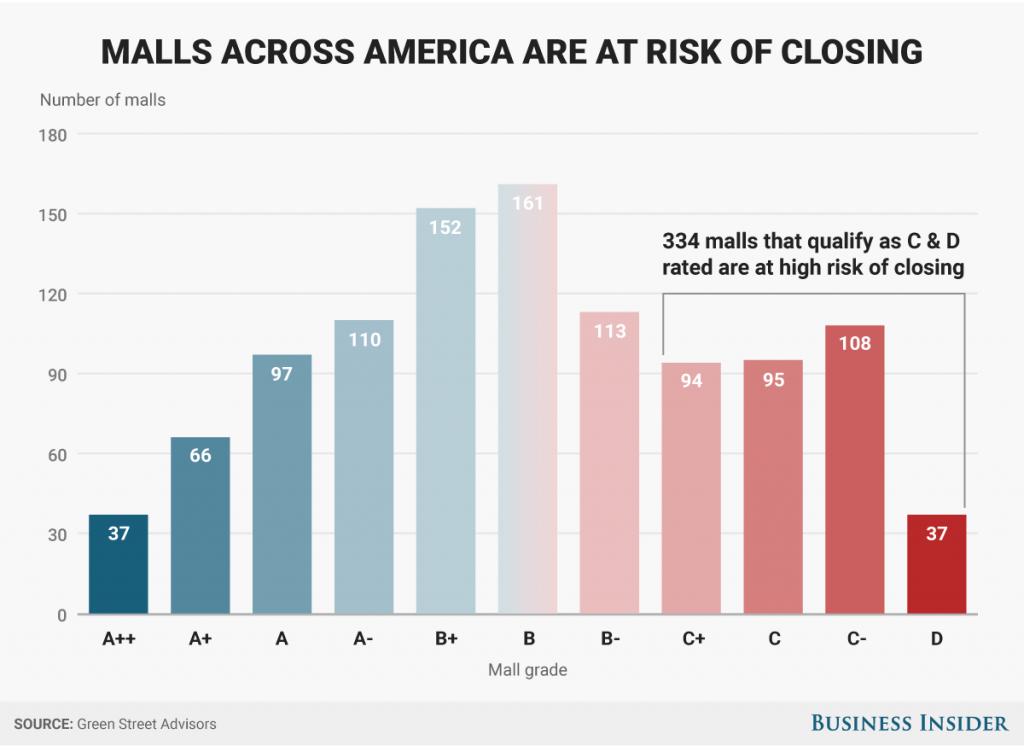

A new article from Business Insider looks at the continuing decline of indoor malls around the country. Of the 1,300 malls in the US, a staggering 310 are ‘in high risk of closing’. The largest culprit is the loss of anchor tenants like Macy’s, JC Penny, and Sears – all of which have been seeing large numbers of store closings in part due to the rise of e-commerce (see earlier post about this).

The article discusses the range of consequences of these closings including a rise in crime, increasing blight in the surrounding area, and the loss of municipal revenue coupled with a rise in costs for needed fire and police services. Dead malls – and the e-commerce that is contributing to their demise – have large repercussions for cities.

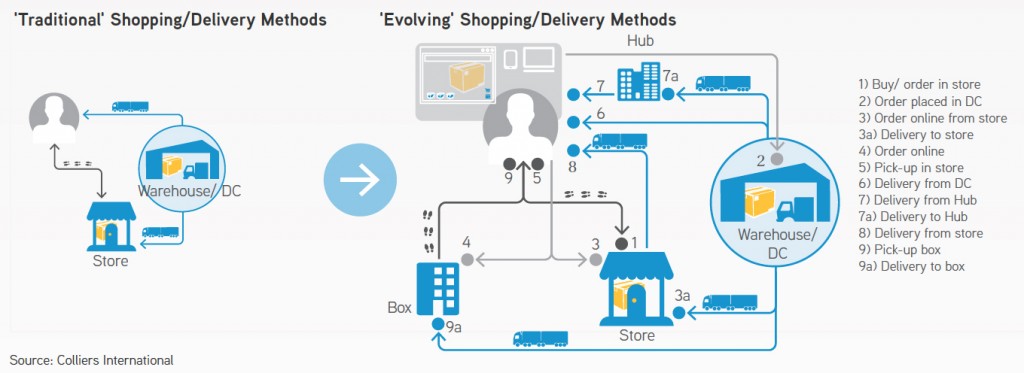

As e-commerce expands and potentially reduces the number of strip malls as well (in addition to enclosed malls), these repercussions will amplify. A recent conversation with the planning director of a suburb city focused around the devastating effects the reduction of strip malls and commercial activity in his city would have on municipal revenues. This was especially difficult as he saw limited abilities, compared to more urban locations, for suburban cities to redefine themselves and create vitality, draws, and their associated revenues.