Over the last few months, we have been talking some about how the trucking industry could be impacted by AVs – see here and here.

The push for automation in the trucking industry continues to build. Trucking companies have been installing equipment to partially automate their rigs over the last few years—similar to many features added to mainstream cars/SUVs. This includes assisted braking and collision-avoidance systems. Automated lane steering is coming too. Beyond the tweaks to rigs on the road today, it is expected that over a billion dollars will be invested in the self-driving truck AV innovations this year.

The cultural resistance of gear-heads to give up their cars is not a phenomenon that is expected to pose challenges in the trucking industry. Consequently, it is likely that the big-rig operators will be in the AV game far earlier than the ‘average Joe’ on the street.

The trucking industry also doesn’t see the complete removal of drivers from the cabs of the rigs anytime soon. Unlike AV cars, long-haul trucks spend most of their lives on the vast stretches of highway that can be less complex to navigate that the chaos of city streets. A study by Roland Berger would give credence to the idea that intra-city truck driving may be harder to automate based on current cost models –but long-haul trucking is more susceptible. Some are projecting that a truck driver’s future career might be piloting trucks closer to home—driving upward to 30 different rigs in a day—guiding them from the highways to their final destinations. Many of the AV truck companies “are almost universally pitching themselves as a friendly partner [to the industry] instead of a job killer” because they are trying to “increase productivity, but also make the job more attractive.” This is going to be very important as there are shortages of drivers nationwide, and AVs may help to make the job more attractive and less stressful.

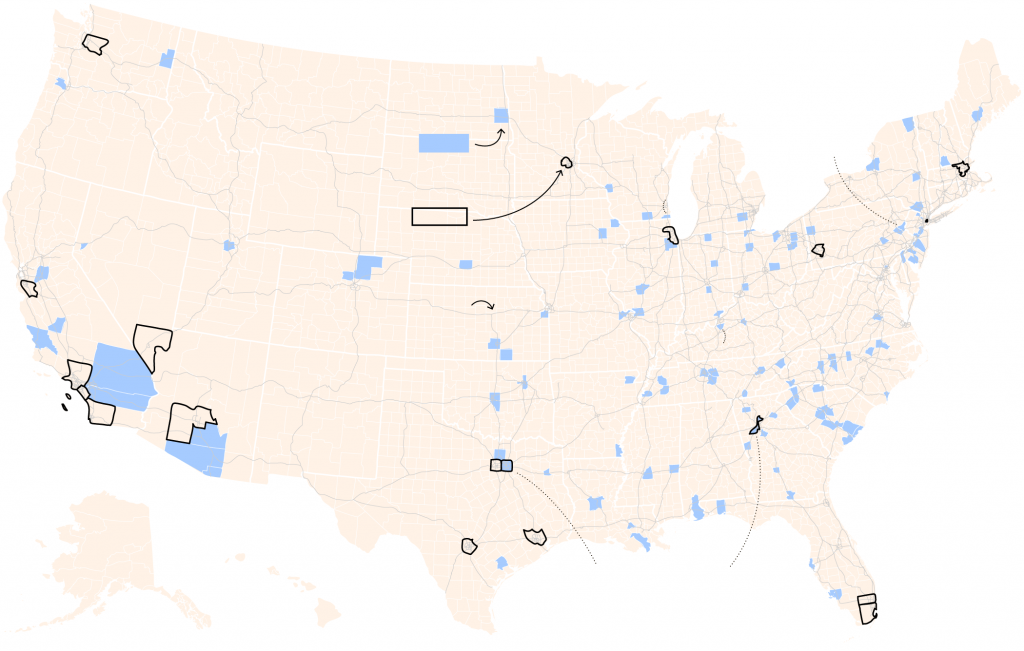

Savings for the trucking industry will come from savings on insurance by reducing crashes, being able to keep drivers driving long and keep them more rested, and by platooning to save on fuel costs. Many of these things are already happening, but as the technologies advance, the savings are expected to grow exponentially. AV trucks are on the road around the country, but their impact is still not quite realized.