The typical U.S. commute trip fills a multi-seat car with a single human being (25% of capacity) and that car sits idle most of its existence (90% of the time). This is an inefficient use of our limited roadway capacity, land for storing vehicles, dispersed settlement pattern and provision of services/utilities, use of fossil fuels, etc. But imagine if we look back at the single occupancy vehicle as a golden age of efficiency?

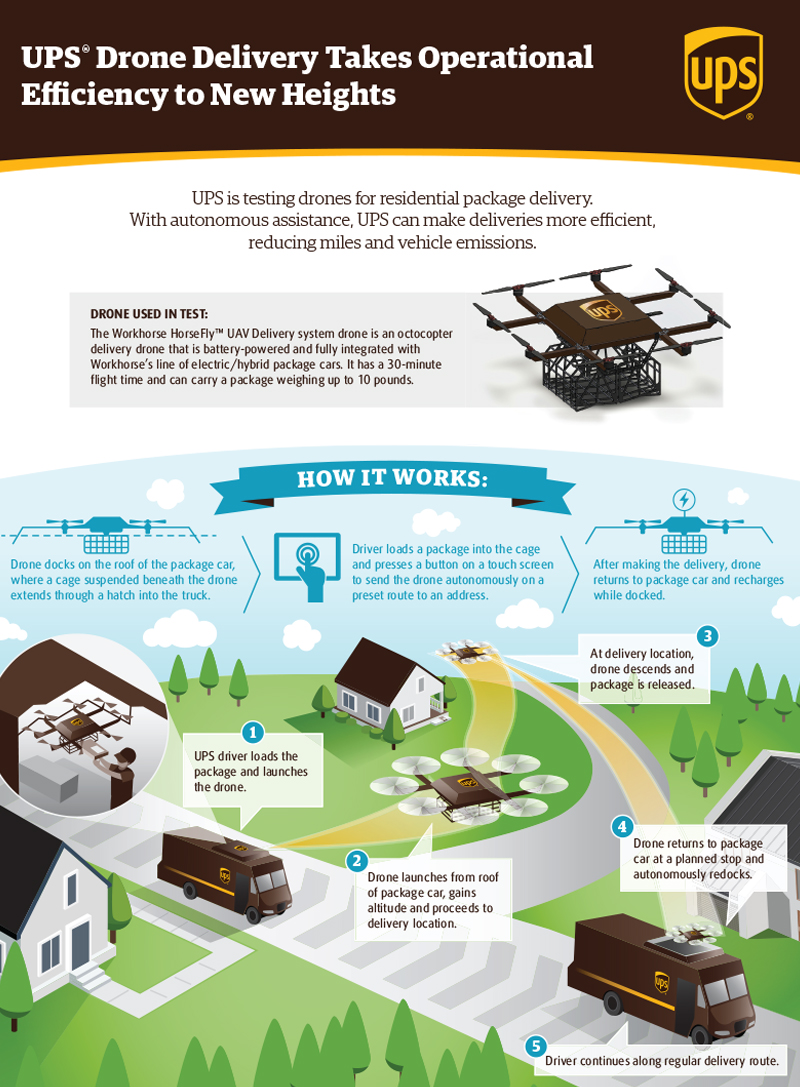

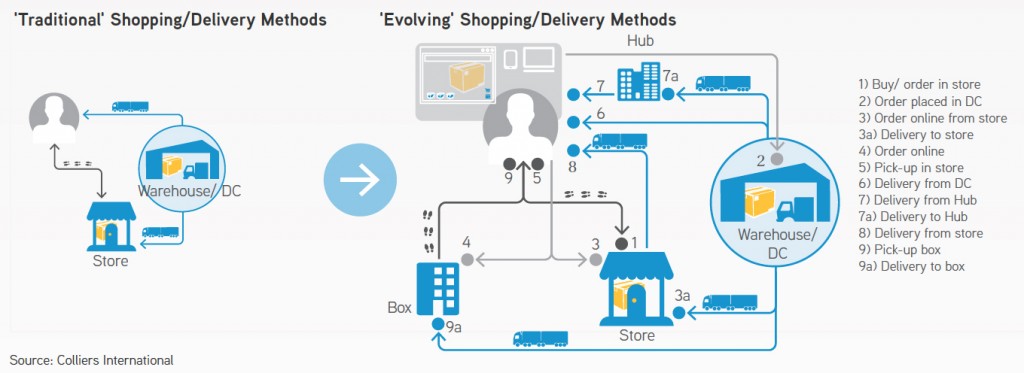

Autonomous Vehicles don’t need drivers, meaning that if we own them personally, many trips by car will be taken with no one inside. An AV could drop you off at the market and circle the block until you are done. It could drop you off at work and return home or other remote parking space. An AV could be summoned to pick up your child at school and take her to soccer practice. While there is certainly some convenience in any of these scenarios, a good portion of all those trips will have no occupants and thereby taking up limited and valuable space on the street.

This article by Howard Jennings of Mobility Lab discusses three ways to apply the principles of Transportation Demand Management (TDM) to AVs: 1) “policies should always seek to encourage AVs that move more people in fewer vehicles”; 2) “pricing models offered by automotive and tech companies should be structured to make shared AVs, not personal AVs, the model of choice”; and 3) city pricing models should be structured to disincentives the least efficient mode of transportation. including a fee for zero occupancy vehicles.